It’s crucial to carefully review each transaction, ensuring that the changes made align with the accurate financial data. This meticulous process guarantees that the ongoing reconciliation process maintains integrity and reliability. This action triggers the ‘Delete Bank Reconciliation’ feature, allowing you to make adjustments and rectify any discrepancies in the reconciled transactions. Once the ‘Delete’ button is clicked, a confirmation prompt appears, ensuring that the user can confirm the deletion before proceeding. This action prompts the system to reverse the previous reconciliation and takes the user to the beginning of the process, allowing for modifications or corrections to be made.

How to unreconcile a monthly statement that has already by reconciled?

Reconciling your accounts is an essential accounting task. In accounting, reconciliation is the process of matching transactions you’ve entered into your accounting software with the information on statements from outside sources, usually financial institutions. This is a checks-and-balances measure that lets you verify the accuracy of your accounting records. When done correctly, it also helps you prevent fraud in your business. This process involves utilizing the ‘Undo Reconciliation’ feature to reverse the reconciled transactions temporary and permanent differences and then making necessary adjustments.

- We believe everyone should be able to make financial decisions with confidence.

- From there, you should select Reconcile and then locate the account for which you want to undo the reconciliation.

- However, you can unmark a reconciled transaction included in the reconciliation and include the correct one to fix the error.

Your greed has motivated me to find a new company to work with. If you see an error message in your beginning balance after clicking the Reconcile button, it means there are still errors in your records. Investigate the cause of the error by carefully double-checking your transactions and fixing the reconciliation again. Reconciling your accounts is a critical accounting function in your business and one that should be completed regularly.

If you need to undo a previous reconciliation for an entire month, you’ll need your bookkeeper to do it using QuickBooks Online Accountant. From the chart of accounts, locate the account that has the reconciled transaction. Based on our sample scenario above, let’s find the Bank of America Checking Account, and then click View register under the Action column. This will open the bank register, displaying all the transactions recorded for that account. Keep in mind, even small changes can unbalance your accounts.

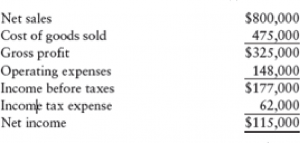

Accounts reconciled

But if you’ve reconciled a transaction by mistake, we’ll show you how to remove individual transactions from the reconciliation. Once on the Reconcile Page, users can easily locate the specific account they wish to work with using the intuitive navigation features. From there, selecting the ‘Undo Reconciliation’ option allows for a streamlined pathway to reverse reconciled transactions. Deleting a reconciliation in QuickBooks Online necessitates a systematic approach to ensure how to calculate monthly accumulated depreciation the accurate removal of previously reconciled transactions and accounts.

Why Would You Need to Undo a Reconciliation in QuickBooks Online?

Unless the status for each transaction is changed in the register they will not appear as available for reconciliation. I unreconciled every transaction from a previous statement, but QB still won’t let me go back re-reconcile for that month. I also just want to chime in to say how much of a disgrace and sneaky it is that Intuit force users to purchase ANOTHER package in order to do a simple task such as undoing a reconciliation.

They will be reverted to their unmarked status and they will appear as uncleared in your next account reconciliation. See articles customized for your product and join our large community of QuickBooks users. Reconciliation in QuickBooks Online is essential for businesses to maintain financial integrity and ensure seamless operations.

Once the adjustments are made, the platform recalculates the account’s reconciliation status to reflect the accurate financial position. Correcting a reconciliation in QuickBooks Online entails identifying and rectifying errors or discrepancies after-tax cost of debt and how to calculate it in previously reconciled transactions and accounts to ensure financial accuracy and compliance. Undoing a reconciliation in QuickBooks Online involves a series of steps to ensure the accurate adjustment of previously reconciled transactions and accounts. Accurately reconciling your accounts will take some time; however, the accuracy of your bookkeeping and the ability to quickly detect errors — or worse, fraud — is worth the extra effort. If you find yourself spending too much time on reconciliation or needing to undo reconciliation often, consider engaging an external bookkeeper or accountant to help you with the process.

In register view – uncheck every R that was in the reconciliation, which reinforces importance of printing a recon detail report each and every time. Accountant users can view more than the most recent. Alternatively, you can invite an accountant to help you unreconcile the transactions. I’d be happy to help you unreconcile your past bank reconciliations so they don’t throw off your records, akrill.

Or sometimes the beginning balance or ending balance on the account for the period you’re reviewing was entered wrong. We recommend reviewing your opening, beginning, and ending balances first to be sure you’ve ruled out any possible errors. To start the process, you would first need to open QuickBooks and navigate to the Banking menu. From there, you should select Reconcile and then locate the account for which you want to undo the reconciliation. Once the account is selected, you can click the “Undo Last Reconciliation” option.